Home Improvements Using Your Homes Equity

Are there some major projects in your future? For example, maybe it’s time to replace all the windows? Perhaps, you have outgrown your garage and you are looking to expand the space? It’s possible that it is time to replace the roof?

You will need a large chunk of change for those types of projects. No matter if you do it yourself or hire a professional contractor to complete the work. Consumers should explore all financing options before deciding on a loan.

You will need a large chunk of change for those types of projects. No matter if you do it yourself or hire a professional contractor to complete the work. Consumers should explore all financing options before deciding on a loan.

Things you may want to consider

What is the time estimated amount of time this project will take to get completed?

What will the overall cost of this project cost after all expenses are calculated?

Will I need any additional money for anything other than the home improvements?

Let's discuss the project sizes and recommended methods of financing them. We will start with the small jobs, those are projects below $1000. It would be best to use your credit card. The funds would be available instantly and you could start right away if needed. The drawback to credit card loans is that typically their interest rates are higher than other types of financing. However, there are no appraisals or additional paperwork to fill out.

Utilizing the equity in your home is a low-cost financing option you may have available to you so you can complete those medium to large home improvements. After all, way not tap into available resources such as a HELOC (home equity line of credit) if the situation demands it.

Utilizing the equity in your home is a low-cost financing option you may have available to you so you can complete those medium to large home improvements. After all, way not tap into available resources such as a HELOC (home equity line of credit) if the situation demands it.

Many financial institutions offer home-improvement loans in the way of home equity loans. Most home-equity loans are structured to have better rates than other types of loans. In addition, interest payments on home equity loans qualify for federal income tax deductions.

What is a Home Equity loan?

Let’s dive a little deeper into what a home equity loan is. Basically, the homeowner is borrowing funds against their property and using it as collateral. In most cases, if you need to borrow large amounts of cash or if your credit rating is not superb, the home equity line of credit will be an attractive option.

Lenders are often more liberal on these types of loans because they are seen as less risky than other loans. They know if you default on your home equity loan, you can’t magically make your home disappear. Also, they understand that making payments on this will likely be a priority because your home is at stake.

What are the advantages of Home Equity Loans?

Well, there are several factors that make the Home equity loan attractive:

Usually, the interest rates are lower.

Getting qualified is much easier for someone that doesn’t have good credit.

Tax friendly on interest payments.

Depending on the amount of equity you have in your home you can borrow relatively large amounts of money.

Home equity loans are could turn out to be good investments. For example, say you have $30,000 of equity in your home. You take borrow $25,000 from that equity to that garage addition and you maybe even remodel your bathroom. By completing those improvements, it increased your home’s value.

Important notes

An important note though, often home equity loans are offered as variable interest rates instruments. That means the interest rates can go down, but it also means it could swing upwards – increasing your total payment. Fixed rates are available, but you may have to specifically request them. If you forecast that interest rate might rise over the period of your load, a fixed rate would be the best option.

Compare your options. Ensure that the home equity loan being offered to you fits your needs better than borrowing from your credit card. Budget, budget, budget. Be certain that this extra payment doesn’t overburden your financial means. Also, you may want to consider accepting some insurance coverage to protect you in case of some unforeseen situations.

In conclusion, when exploring financing on your home improvements, take the time to check all of the different options that may be available to you. In most cases on larger projects a home equity loan probably will be your best financing option.

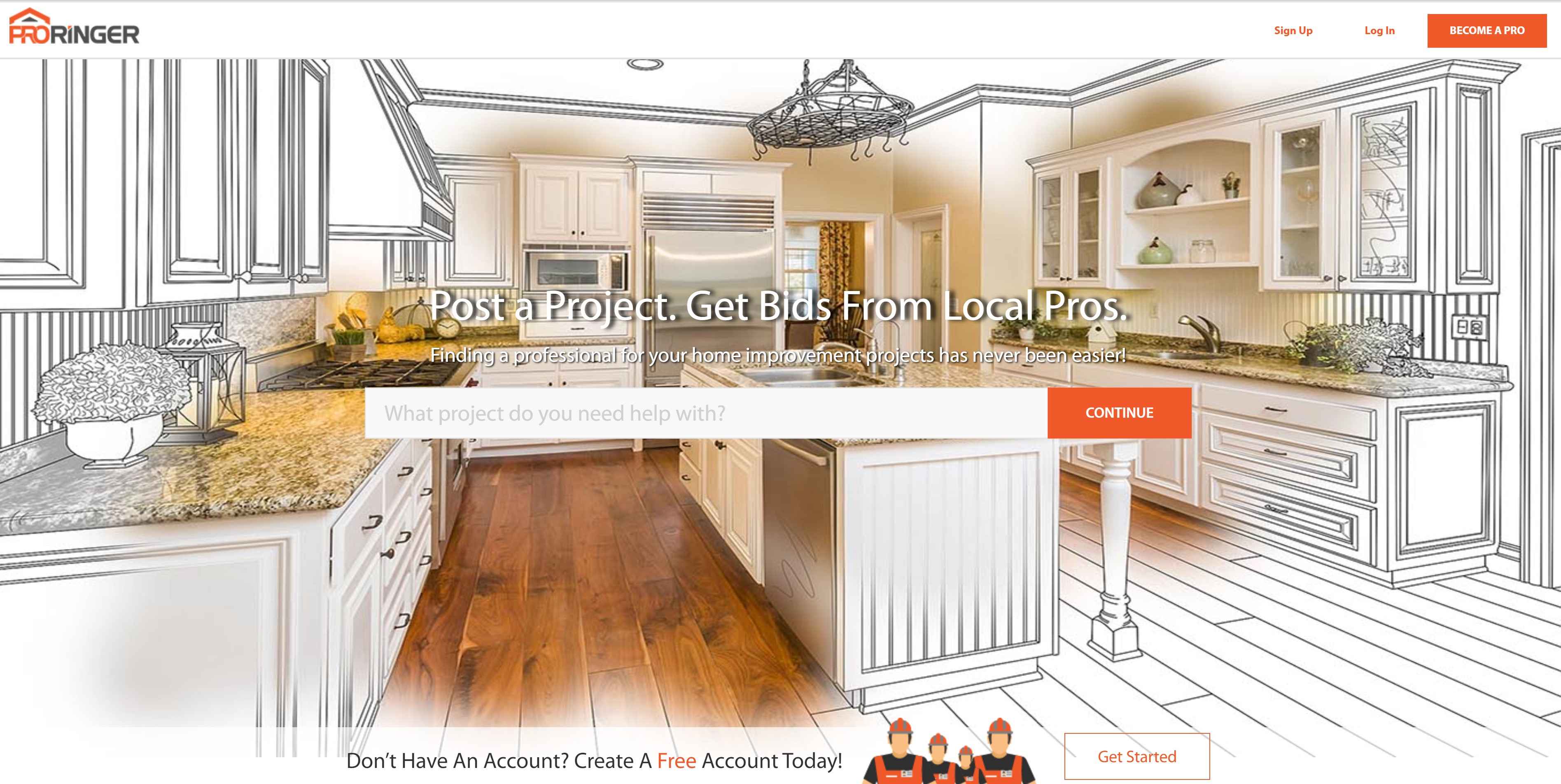

FIND A PRO IN YOUR AREA

Featured Articles

Leave a comment